Credit History 101

Credit history is often the biggest stumbling block between you and getting access to credit. In this post, we are going to explain the basics of credit history and how you, as a non-U.S. citizen, will be able to build your credit history.

What is credit history?

A credit history is a record on how responsible a borrower is in his debt repayment. It is the main tool for lenders to assess your creditworthiness. In the U.S., each credit history is linked to the Social Security Number (SSN), and it contains information such as your pattern on taking

Your credit worthiness is measured using a credit score.

Why are credit history and credit score so important?

Credit history is essential in getting access to

For international students (F-1 visa holders), having credit history with a decent credit score will allow you to refinance your student

For H-1B visa holders, your access to personal

The same also applies to people on O-1, L-1, G-1, TN visas.

Credit history can also affect non-credit related things, such as:

- Rental Deposits: Depending on the landlords and the types of apartment, if you do not have credit history, your landlord may require higher rental deposits.

- Post-paid phone plans: You will be asked for a $500 deposit at most stores without a credit history.

- Health Insurance Premiums: The premiums are generally higher for international people without credit history.

Read the 7 unexpected expenses to keep in mind when moving to the U.S.

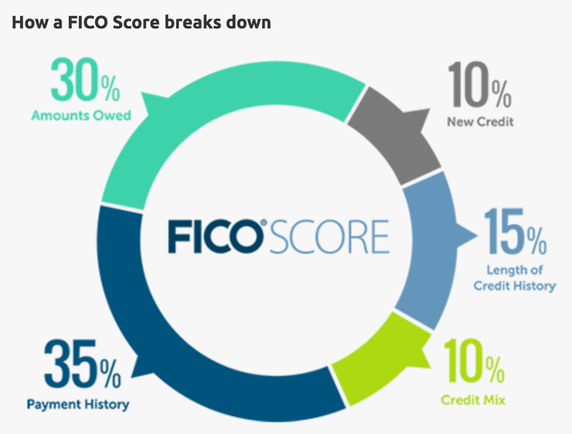

How is credit score calculated?

There are 5 major components to a credit score:

- Payment History — This is the most important factor. It shows how regularly and timely you are in making payments on your previous credits. Being late on your credit card and other credit payments will hurt your score.

- Credit Utilization — It is important to maintain a good utilization rate (< 30% of your credit limits). Maxing out your credit card will hurt your credit score.

- Length of Credit History — This shows that you can consistently use credit responsibly. The length of your oldest credit account also matters.

- Credit Mix — Having different accounts and types credit accounts can show that you can manage different types of debts.

- New Credit — Low number of recent credit inquiries are important to show that you are not looking for credit all the time.

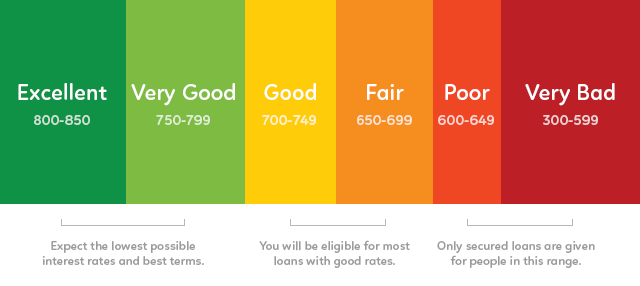

Below is the scale of credit score and what it means to your access to

If you do everything right, building an excellent credit score of >800 takes around 6 years. This is because the length of your credit history is also taken into account, and it is important to show that you can consistently use your credit effectively over a period of time.

Why is it difficult to build credit history for foreign nationals?

For foreign nationals, it is already difficult to start building credit history, let alone getting an excellent credit score.

In order to build credit history, you need to have access to credit. However, the way U.S. credit system is setup, you don’t get access to credit unless you have a credit history. It is basically a catch-22.

If you are a student or have a checking/deposit account with a bank, you could get a credit card with a small limit at 29.99% APR or higher after 6 months of credit history.

Personal

Personal

They need a strong credit history (only 3% of the applicants with less than 6-year credit history are approved on Lending Club). Interest rates are generally high for people with limited credit or imperfect credit history. Moreover, credit score is not useful if you don’t have a long enough credit history.

If you go to websites offering these

loans , you’ll most likely be rejected because of your limited or zero credit history (irrespective of your credit score). Even if approved by a lender, the average APR for you could be anywhere between 27%-36%.

What can a foreign national do to build credit history?

Luckily, all is not lost. There are still a few ways for you to build credit history and get a good credit score:

- Apply for a secured credit card: If banks are not approving you for a card even with a smaller limit, get a secured credit card. These are credit cards that are backed with a cash deposit from you. The credit limit is equal to the amount deposited. People usually get a $1,000-$3,000 limit card to start with. After 6-12 months, you can convert your secured card to an unsecured card. This will help you get on the right path to build a credit history. For students, some companies may partner with your university to offer credit cards with lower limits. Once you get such cards and build your credit history, it will open doors to other credit cards.

- Apply for a credit builder loan: There are several companies that can give you a small loan to help you get on the grid of U.S. credit system. They may ask you to provide the deposit which they will lend to you but the good thing is that they will report it to the bureaus. This will get you started with a credit history.

- Get a co-signer: If you have family, relatives or close friends who can act as a cosigner for your credit product, you can piggyback on their credit history to get started. Remember that they will be liable to pay for your defaults, so make sure they know this and are comfortable with co-signing. Be sure to make timely payments since otherwise both yours and your co-signer’s credit history will be tarnished.

- Become an authorized user on someone else’s credit card: Another option is to become a user on a credit card of your family member or a relative. You will get all the benefits of a credit card and start building credit history but not be obligated to pay for charges.

Why STILT?

While not impossible, building credit history to get access to

We started Stilt to fix this problem for non-U.S. citizens. We do not require credit history, co-signer or even SSN. In our application process, we take into account a lot of additional factors that other lenders ignore. Our interest rates are only between 10%-16% (the lowest in the industry).

And the best part is, our

About Stilt:

Stilt provides