I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See all posts Frank GogolHow to Get a Sales Tax Refund When Visiting the U.S.

At a Glance

- Sales tax refund policies vary by state in the U.S.

- Refunds for sales tax on domestic purchases are generally not available, except for exported items.

- Texas and Louisiana offer sales tax refunds for international travelers with specific requirements.

- Requirements for a refund include presenting original receipts, meeting minimum purchase amounts, making purchases within 30 days of departure, and taking the items out of the U.S.

Foreign visitors to the U.S., including those on B1 and B2 visas, contribute to the 79 million international tourists annually. While shopping, they pay sales tax like U.S. citizens. Some states offer sales tax refunds for these visitors, although the process varies. This article will explore states allowing such refunds and outline the claim procedures.

Can Visitors to the U.S. Get a Sales Tax Refund?

Generally, the U.S. does not offer sales tax refunds to non-resident visitors who purchase and take possession of items within the state. This differs from countries with a VAT system where such refunds are more common.

Understanding Sales Tax Refund Policies in the USA

In the United States, sales taxes are imposed at the state or local level, as there is no federal sales tax. When purchasing goods in the US, the tax paid goes to the state or local government, not the federal government.

The U.S. Federal Government primarily imposes customs duties or tariffs at a federal level, which are different from sales taxes and aren’t directly charged to consumers. In some cases, you may be eligible for a refund of the state sales tax if you’re exporting goods outside the US.

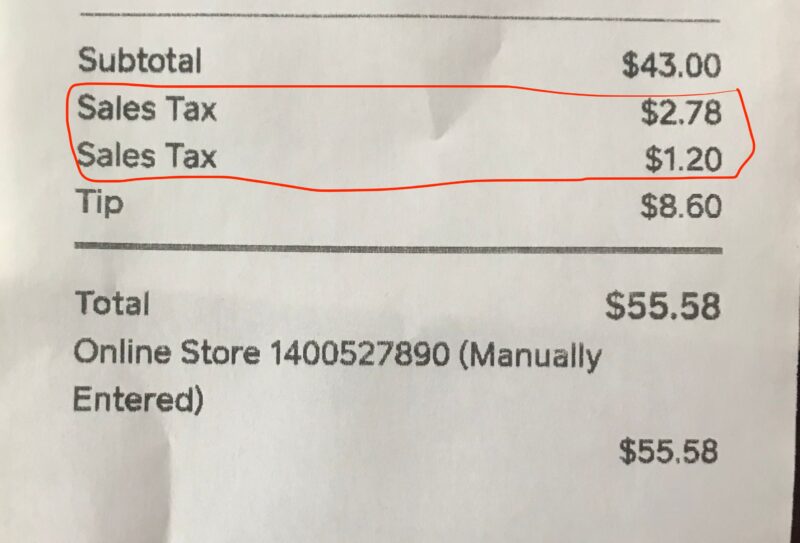

The sales tax is generally mentioned separately on the receipts. Sample image below.

Sales Tax Refunds in the US

The US Government, as clarified by US Customs and Border Protection (CBP), does not refund sales tax to foreign visitors. Sales tax in the US is a state matter and not federal. Therefore, refunds, if applicable, depend on the specific state where the purchase was made.

This understanding is crucial for international visitors who might be considering tax refunds on their purchases in the US. The next section will delve into specific states and their requirements for tax refunds.

Sales Tax vs. Value-Added Tax

Many people get confused when it comes to sales tax and value-added tax. You may be using those terms interchangeably, but they are not the same.

- Sales Tax – Sales tax is collected by the seller at the end of the supply chain, i.e., the merchant who is selling to the end consumer. In most cases, it is the retailer you are shopping with. Tax departments do collect sales tax, but they do not receive it until the final sale is made to the end consumer.

- Value-added tax (VAT) – VAT, on the other hand, is collected by all sellers involved in a supply chain from manufacturers all the way down to delivery agencies. Tax departments receive the respective VAT at each stage of the chain.

When claiming tax refunds, it is the sales tax you are claiming and not the VAT.

Which States Offer Sales Tax Refunds to Visitors?

Currently, just three U.S. states offer sales tax refunds to visitors. These states include:

- Louisiana

- Texas

- Washington

Below, we’ll explain in more detail the specifics for each state.

Louisiana

Louisiana offers a tax-free shopping program in New Orleans for foreign visitors under certain conditions:

- Louisiana Tax Free Shopping Program: Available for foreign visitors in the U.S. for less than 90 days. Eligible for sales tax refunds on material movable property permanently removed from the state, excluding food and beverages consumed in-state.

Texas

Texas provides sales tax refunds for international visitors through private companies, with specific requirements:

- Texas Sales Tax Refund: International visitors can get refunds through private companies by shopping at participating stores and providing original receipts, travel documents, and proof of purchase within 30 days of departure.

Washington

Washington exempts sales tax for non-residents under certain conditions, particularly when goods are used outside the state:

- **[Washington State Exemptions](https://dor.wa.gov/education/industry-guides/restaurants-and-retailers-prepared-food/retail-sales-tax#:~:text=Washington law exempts most grocery,subject to retail sales tax.)**: Non-residents can avail tax exemption on tangible personal property, digital goods, and digital codes for use outside of Washington under certain conditions. This exemption applies when purchases are made in Washington but are used elsewhere.

- Export Sale Exemption in Washington: For a sale to qualify as an export sale exempt from retail sales tax, the goods must be delivered to another country, to a carrier for international transfer, or directly to the buyer’s vessel. Sales to an out-of-state buyer’s customs broker in Washington for local delivery do not qualify as exempt export sales.

Requirements to Get a Tax Refund in the U.S.

Now that you know which states will provide a tax refund, it’s time to learn what procedures you must follow to receive it. Here’s some general guide for what you need to get a sales tax refund:

- Original Receipts are Crucial: Keep all original paper receipts from your purchases. Digital or email copies are generally not accepted, except from well-known brand stores.

- Meeting the Minimum Purchase Requirement: Different states have varying minimum purchase amounts for tax refund eligibility. For instance, Texas requires a minimum of $12 in sales tax per receipt.

- Timeliness of Purchases: Ensure your purchases are made within 30 days prior to leaving the US, as this is a common criterion across states.

- Exporting Purchases: Items claimed for tax refunds must be taken out of the US, aligning with the concept of tax benefits for exports.

- Inspection of Items: Be prepared for a physical inspection of the items at the airport. They should be new, unused, and have all labels attached.

- Required Travel Documents: Have your valid passport and Form I-94 (Arrival/Departure Record) ready, along with potential additional documents.

- Flight Details: Show evidence of your international departure, like flight tickets or itineraries.

- Shopping at Participating Retailers: Purchases must be made at stores participating in the state’s tax refund program, primarily comprising branded stores.

Each state may have its own specific rules and requirements, so it’s essential to check the details for the state where you made your purchases.

Where to Request Your Sales Tax Refund in the U.S.

You can claim your refunds at the airport where you’ll be departing for your home country. Get in touch with the airport’s central information desk; they should guide you along the way. But please be advised to arrive at least a few hours earlier than usual since the inspection may take longer.

Best Lenders for Personal Loans

Avant (Best for Quick Approval)

550

9.95-35.99%

N/A

AmOne (Best of Low Credit Score)

Upstart (Best for Fair Credit Score)

OneMain Financial (Best for Good Rates)

None

18.00-35.99%

N/A

SoFi (Best for Good Credit Score)

Best HELOC

Read More

- How Many Times Can You Enter the U.S. on a B1/B2 Visa?

- How to Get a U.S. Tourist Visa for Your Parents

- Best Visitor Insurance in the USA

- Tourist Visa Sponsor Documents Guide

- Guide to Visitor Visa Extensions

- B2 Visa Interview Questions

Final Thoughts

The sales tax refund is a win-win for everyone. Merchants get to sell more products, and tourists get to buy more and enjoy the refunds. We can expect more states following suit in the near future. Always check a state’s Department of Revenue website for updates.

Getting a Sales Tax Refund in the U.S. FAQ

Below, you will find some common questions about getting a sales tax refund in the U.S and their answers.

Can visitors get a sales tax refund in the U.S.?

Generally, the U.S. does not offer sales tax refunds for purchases made within a state. However, there are exceptions in states like Louisiana, Texas, and Washington.

What is Louisiana’s tax refund policy for visitors?

Louisiana offers a tax-free shopping program in New Orleans for foreign visitors staying less than 90 days. Eligible purchases must be material movable property permanently removed from the state.

How does Texas handle sales tax refunds for international visitors?

Texas allows international visitors to get a sales tax refund through private companies, provided certain conditions are met, like shopping at participating stores and producing original receipts.

What are Washington’s sales tax exemptions for non-residents?

Washington offers tax exemptions on certain purchases for non-residents, provided the goods are used outside of Washington.

Are there any specific requirements for sales tax refunds in these states?

Yes, each state has specific requirements, such as eligibility criteria, type of goods eligible for refunds, and submission of original receipts and travel documents.

Do visitors need to physically present purchases for tax refunds?

In some states, physical inspection of goods at the airport may be required for a sales tax refund.

Can food and beverages be eligible for sales tax refunds?

Generally, purchases of food and beverages consumed within the state are not eligible for sales tax refunds.

Is the sales tax refund process the same in all U.S. states?

No, the process and eligibility criteria vary by state. It’s important to check the specific rules of the state where purchases were made.