I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See all posts Frank GogolHow to Add a Credit Card to Cash App

At a Glance

- To add credit to your credit card to your Cash App account: “My Cash” > “Credit Card.”

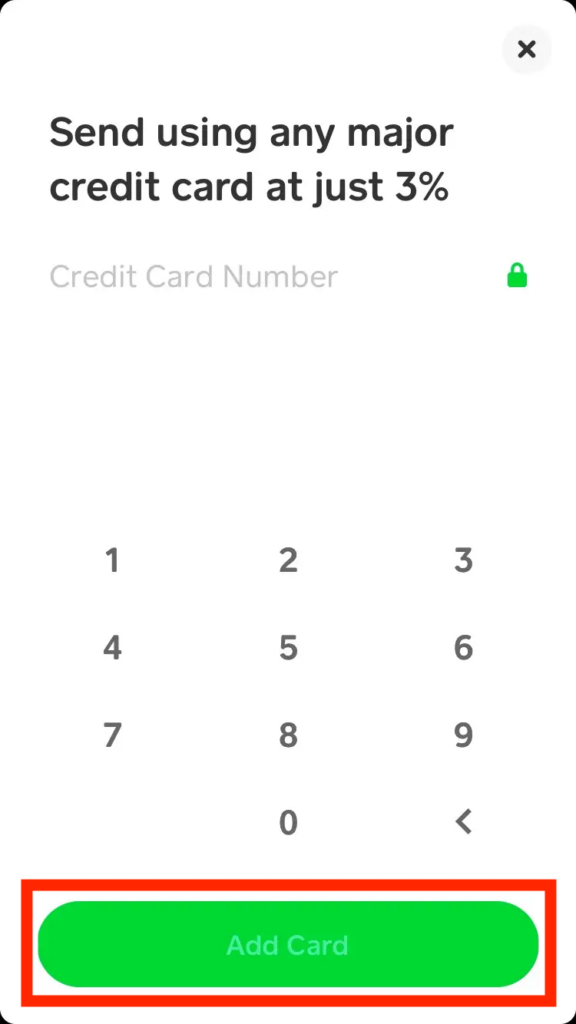

- On the next screen, enter your card information and enter your touch ID or pin to save the info in Cash App.

Cash App has become one of the most convenient applications. It lets you send and receive money to and from family and friends. This could be useful for situations when someone doesn’t have actual cash. But to be able to withdraw from Cash App, you must link a credit card to your Cash App account.

So, how to add a credit card to Cash App? Learn everything there is to know in this article.

Can You Link a Credit Card to Cash App?

You can link major credit cards like American Express, MasterCard, Visa, and Discover to Cash App, but you must first add a debit card or bank account. Initially, this feature wasn’t available, but it was introduced for added convenience. Linking allows you to transact without exposing sensitive bank or card details. While you can receive money without linking a card, you can’t send funds or cash out, making linking crucial.

How to Add a Credit Card to Your Cash App

After activating Cash App, you’ll need to link a credit card to deposit or withdraw funds. Ensure you have your card details (expiration date, number, and secret code) ready. Enter them carefully into Cash App; even minor errors will prevent linking. It’s advisable to double-check your inputs. Here’s how to link your credit card to Cash App:

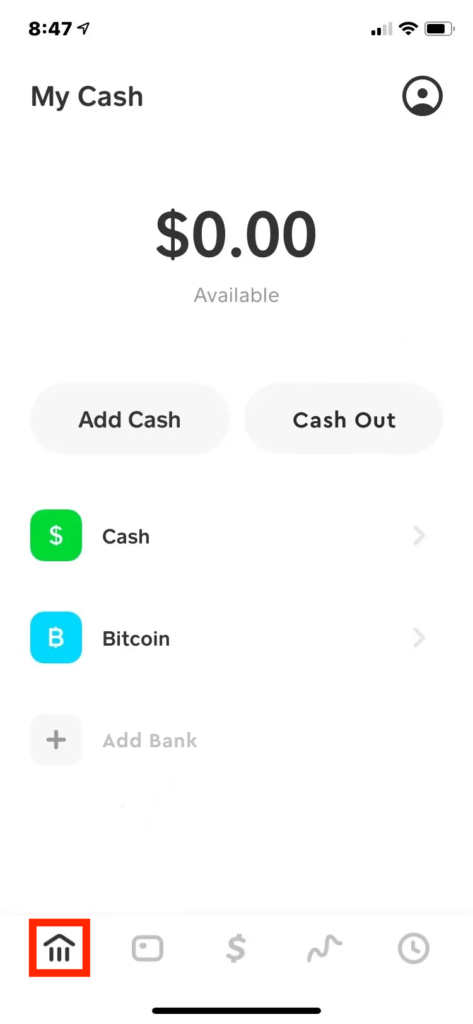

1. Open Cash App and ensure you’re logged in.

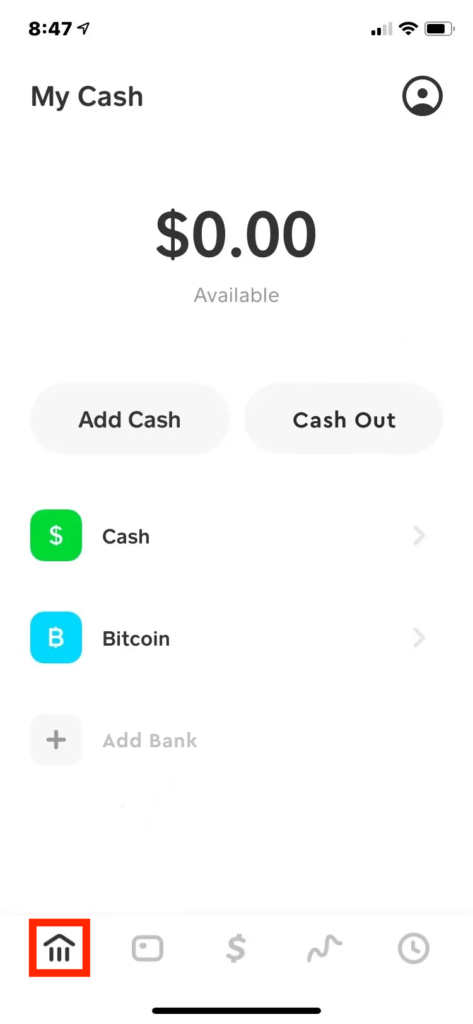

2. Tap the “my cash” or banking button with the $ sign.

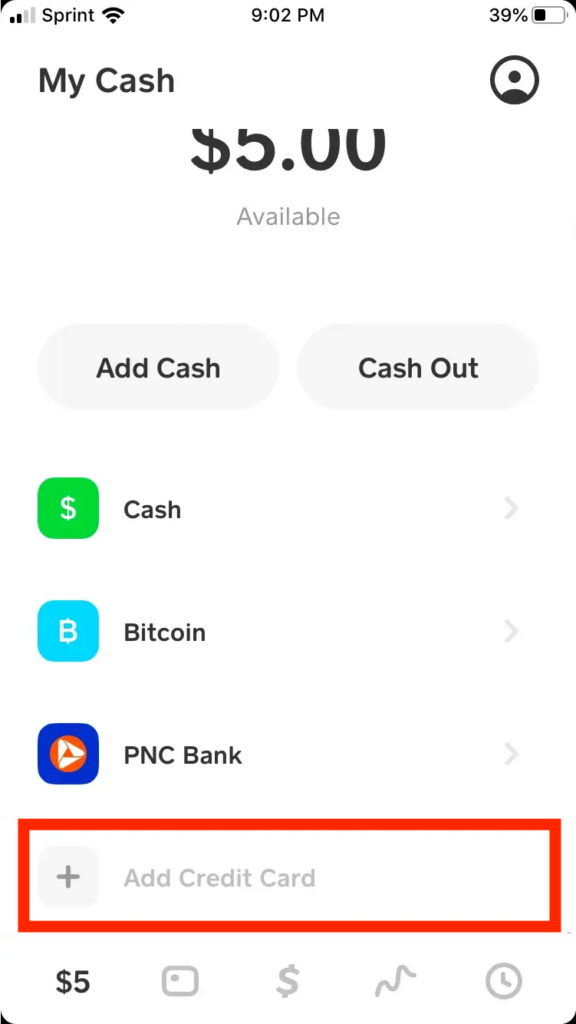

3. Below the bitcoin and cash tab, select the credit card option.

4. Enter your credit card number, CVV, and expiration date.

5. Follow on-screen instructions and tap “add card.”

6. Confirm with Touch ID or PIN, then return to the homepage.

Your credit card is now linked for transactions on Cash App.

What to Do If You Can’t Link Your Credit Card to Cash App

You’ve learned how to use Cash App. However, there are times when you might face issues, such as being unable to link your credit card to your Cash App. Here’s what you need to know:

Reasons for Linking Failures

- Type of Card: While Cash App supports most U.S. government-authorized credit and debit cards, it doesn’t accept certain cards like prepaid or gift cards.

- Bank Restrictions: Banks have their terms and conditions. Some cards might not be compatible with Cash App due to these. For instance, some banks might charge a fee for linking, preventing Cash App from accepting it.

- Incorrect Details: Entering wrong card details, even a minor typo, can prevent you from linking the card.

Error Messages

- If your card isn’t supported due to additional fees by the issuing bank, Cash App will display: “This card is not supported because the issuing bank charges cardholders additional fees. Please add another card.”

Troubleshooting Steps

- Check Card Type: Ensure your card is supported by U.S. banks.

- Card Validity: Check if your card is expired or deactivated.

- Verify Details: Ensure you’ve entered the correct card information and that it hasn’t been temporarily put on hold.

If all else fails, you might need to consider using a different credit card or contacting Cash App support for further assistance.

How to Link Your Bank Account to Your Cash App

Since you need to add your bank account to Cash App before you link your credit card, it’s essential to know the right steps to take. Here is what you need to do:

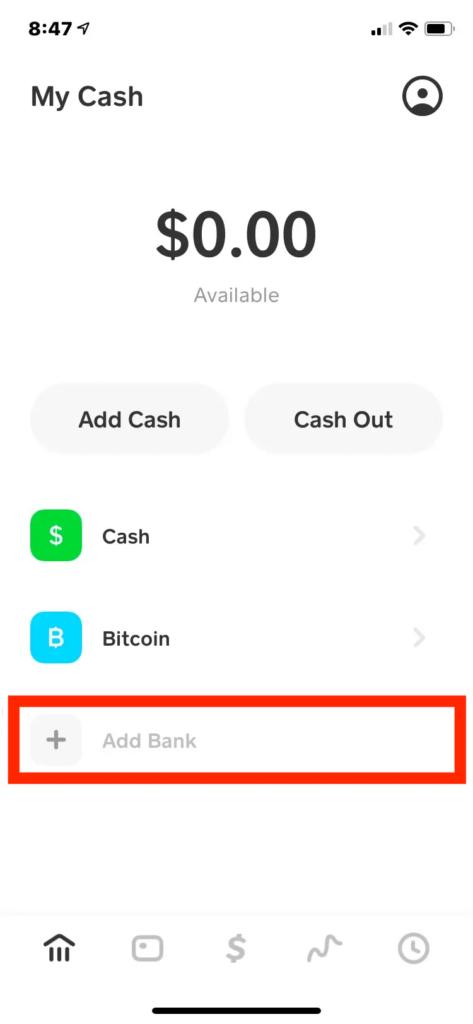

1. Go to Cash App on your phone.

2. Then, look for the “My Cash” tab and go there.

3. Click the “+Add Bank” option that you can find under the “Cash and Bitcoin” option.

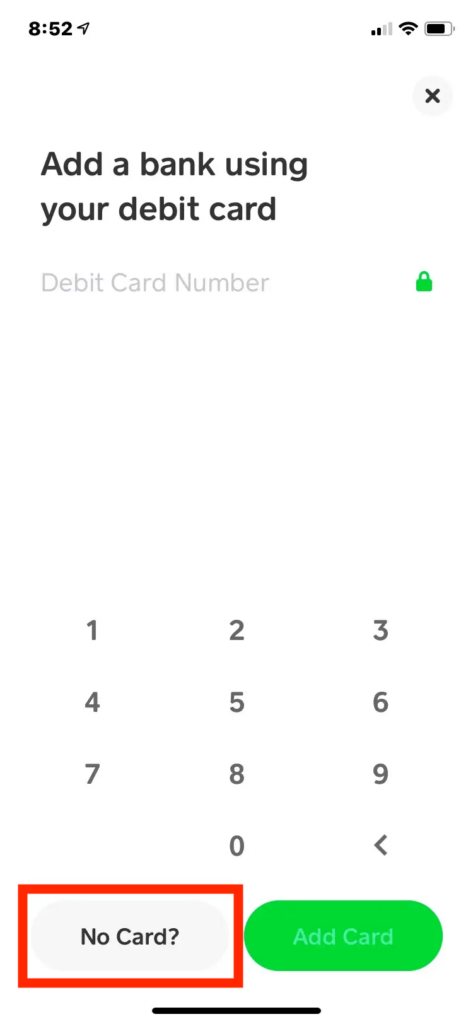

4. Choose “Add Card” to link immediately. If you lack a debit card, select “No Card?” and add your bank account.

5. Pick the name of the bank from the list.

6. Enter your online banking credentials and follow on-screen instructions to link the bank account.

After linking your bank account to your Cash App, you can proceed with adding your credit card.

Best Lenders for Personal Loans

Avant (Best for Quick Approval)

550

9.95-35.99%

N/A

AmOne (Best of Low Credit Score)

Upstart (Best for Fair Credit Score)

OneMain Financial (Best for Good Rates)

None

18.00-35.99%

N/A

SoFi (Best for Good Credit Score)

Read More

- How to Get a Cash App Refund

- How to Withdraw Money from Cash App

- How to Close a Cash App Account

- Activate Cash App Card – A Step-by-Step Guide

- Where Can I Load My Cash App Card?

Final Thoughts

If you know what Cash App is and want to use it, you must know how to link a credit card to it. Use the instructions in this post and you will have no issues. We hope the tips we provided will prove useful.

Adding a Credit Card to Cash App: Common FAQs

When it comes to adding a credit card to your Cash App account, users often have questions. Here are some of the most common queries:

Can You add money to a Cash App card from a credit card?

Adding money to a Cash App is not possible without a credit card. The only way to get money on your Cash App account without a card is by requesting it from friends and family or by transferring funds from debit cards.

How do I add a credit card to my Cash App account?

To add a credit card to your Cash App account, open the app, tap on the “My Cash” tab on the bottom left corner, then select “+ Add Credit Card.” Follow the prompts to enter your credit card information.

Can I add more than one credit card to my Cash App account?

No, you can only link one debit card or credit card to your Cash App account at a time. If you want to add a different card, you must first remove the existing one.

Why can’t I add my credit card to my Cash App account?

You might not be able to add your credit card if it’s not supported by Cash App, if your card information was entered incorrectly, or if there’s an issue with your bank. Check your card details and try again. If the problem persists, contact Cash App support or your bank.

Is there a fee for using a credit card on Cash App?

Yes, Cash App charges a 3% fee for sending money using a credit card.

Can I use my credit card to add cash to my Cash App account?

No, as of my knowledge cutoff in September 2021, you cannot use a credit card to add cash to your Cash App account. You can only use a linked debit card or bank account to add funds.

Why Can’t I link My credit card to Cash App?

You may be unable to add your credit card because you entered the wrong information, you’re linking an unsupported card or your card is expired or deactivated.

Are credit cards better than debit cards for cash app?

Credit cards come with additional benefits that debit cards do not possess. However, Cash App also has a debit card with a lot of benefits, like discounts at popular fast foods or restaurants.