I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See all posts Frank GogolHow to Withdraw from Binance and Binance.US

Binance is a platform that many people have started using in the past years. Still, if you’re new to this platform, withdrawing from Binance may be difficult initially. But don’t worry, we’ve got you covered. Read on to find out more info on the matter.

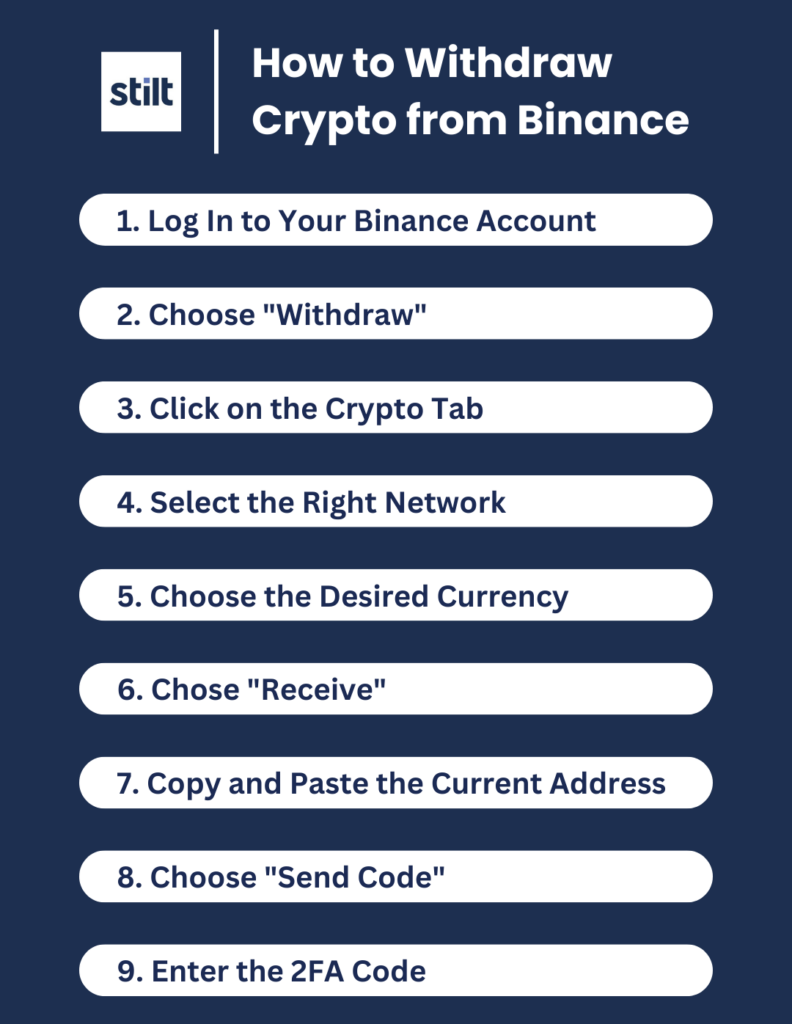

How to Withdraw Crypto from Binance

It is possible to withdraw funds from your Binance account. But in order to make that possible, you will have to go through a specific withdrawal process. It’s not hard, but following every step is necessary if you want everything to go smoothly. After all, the last thing you want is to make a mistake and possibly lose your funds as a result. Here are the steps you should go through:

- Log In to Your Account

- Choose “Withdraw”

- Click on the Crypto Tab

- Select the Right Network

- Choose the Desired Currency

- Chose “Receive”

- Copy and Paste the Current Address

- Choose “Send Code”

- Enter the 2FA Code

Each of these steps is discussed in more detail below.

1. Log In to Your Account

First things first, you need to ensure that you are logged into your Binance account. After logging in, you have to go to Wallet and then click on Fiat and Spot.

2. Click Withdraw

Click on Withdraw after reaching the page.

3. Click on the Crypto Tab

After selecting the Crypto tag, you will be asked to select the cryptocurrency you wish to withdraw.

4. Select the Right Network

Some currencies are issued on various platforms. In this case, you will have to select the one you want to make the withdrawal on.

5. Choose a Currency

In the Trust Wallet, tap on the desired currency for withdrawal.

6. Chose “Receive”

Tap on the Receive option when prompted.

7. Copy and Paste the Current Address

Copy the currency address when prompted. Go to the withdrawal page of Binance and paste the address you just selected. Click on Submit if everything looks good.

8. Choose “Send Code”

Click on Send Code, after which you have to enter a six-digit code that was sent to your email.

9. Enter the 2FA Code

Enter the 2FA code, then click on Submit if everything else is okay. It will be possible to see the withdrawals in your Transaction history afterward.

How to Withdraw Fiat Currency from Binance

Over 60 fiat currencies are supported by Binance, and there are also various payment methods available. So, it is important to know how to withdraw fiat currency from your Binance account. Here are the steps you will have to go through:

- Log into your account

- Select Withdraw

- Click on the Fiat tab

- Pick the fiat currency

- Enter the details that the page requires

- Check the transaction details

- Enter your verification code

Below, we’ll take a look at each of these steps in detail.

1. Log Into Your Account

Just like when withdrawing crypto from your Binance account, you first need to log into Binance to withdraw fiat.

2. Select Withdraw

Click on Withdraw after reaching the page.

3. Click on the Fiat Tab

Click on the tab labeled “Fiat”.

4. Pick the Fiat Currency

Next, choose the that you fiat currency want to withdraw and choose a payment method. Be aware that the payment methods available will depend on your region, as well as your selected currency.

5. Enter the Withdrawal Info

Next, fill in the Withdrawal info, including the amount to be transferred and your bank account information (or that info of the recipient).

Then, click “Continue”.

6. Check the Transaction Details

Check the transaction details to make sure that it is all correct. If it is, click “Confirm”.

7. Enter Your Verification Code

Next, you will be prompted with a security verification. Enter your mobile phone number and click “Send SMS”. You will receive a text message with a Google verification code. Enter the code in the second field, then click “Submit”.

If the correct verification code was entered, you will receive a message say confirming that your order has been submitted.

Binance Withdrawal Fees

Since you are doing a network transaction when withdrawing crypto from your account with Binance, you will deal with some fees. The fees are meant to cover the network transaction cost. Certain currencies, such as Ether or BNB, need Binance to be able to be sent to another crypto wallet.

Therefore, there will be a gas fee when you do any transaction on Binance Chain, Binance Smart Chain, or Ethereum. The fee is paid to miners. The cost of the transaction fee will be passed on to the user by Binance.

Keep in mind that there are different fee schedules for every blockchain. Because of that, the fees for crypto withdrawals will depend on the particular coin that you are using. Also, it is likely for fees to change, as they are dynamic and depend a lot on the network activity. You will have to go to the actual withdrawal page in order to find the accurate withdrawal fees.

Minimum Withdrawal Amount

There is a minimum withdrawal amount for Binance. Every cryptocurrency has its own withdrawal amount. That being said, you will be unable to withdraw a smaller amount than the one stated on the withdrawal page.

If you want to find out the minimum amounts of every currency, you can check them out on the Binance website. There is a list of every minimum amount and the respective withdrawal fee.

How Long Does It Take to Withdraw from Binance?

Withdrawing from Binance may take a bit. This isn’t because Binance is slow or anything. In fact, the platform will deal with the processing of the withdrawal as soon as you make the request. However, every blockchain is different, so the amount of time required for completing the transactions may vary.

For example, Binance Smart Chain may complete transactions in only a few minutes. Bitcoin, on the other hand, will take from about 10 minutes to 30 minutes to be able to mark a withdrawal as successful. Ethereum may take even longer than these two.

So, it really depends on the blockchain. Also, if a network has very high traffic, this will affect the amount of time you have to wait. The higher the traffic, the more your waiting time expands.

Sometimes, withdrawals may end up being stuck in processing, and that is because the blockchain has to confirm the transaction first. In other situations, it may be congested.

There are specific blockchains that require more network confirmations compared to others. So, during heavy traffic periods, you can expect the transactions to take longer than usual.

How to Withdraw from Binance.US

There are two common ways to make withdrawals from Binance.US: using the mobile app and the using the website. We outline both methods below.

Withdrawing via ACH on the Binance.US Mobile App:

- Go to ‘Wallet’ and tap ‘Withdraw’.

- Choose ‘USD US Dollar’ from the withdrawal options.

- Select your ACH account, enter the amount, and preview the transaction.

- Verify the details and confirm the withdrawal.

- Enter any required Authentication Codes.

- Check your email for a Disbursement Confirmation from Binance.US or its payment processor and verify the withdrawal within 24 hours, or it will be canceled.

ACH Deposits can only be withdrawn after 7 days; for immediate withdrawal, consider a wire deposit.

Withdrawing via ACH on the Binance.US Website:

- Log into your account and select ‘Wallet’ then ‘Withdraw’.

- In the pop-up, select ‘USD US Dollar’.

- Choose your ACH account, enter the amount, and click ‘Preview Withdrawal’.

- Confirm all details are correct and click ‘Confirm Withdrawal’.

- If necessary, authenticate the transaction with codes from your authenticator app or SMS.

- Verify the withdrawal via the Disbursement Confirmation email sent by Binance.US or its payment processor within 24 hours.

Note: Withdrawal times can vary from 1-5 business days depending on your bank.

Important: Binance.US No Longer Supports Direct Dollar Withdrawals

Binance.US has updated its withdrawal policies; now users must convert U.S. dollars to crypto before withdrawing. In an email to users, they wrote:

“In the event that customers wish to withdraw U.S. dollar funds from their account, they may do so by converting U.S. dollar funds to stablecoin or other digital assets, which can subsequently be withdrawn.”

This follows a pause on dollar deposits amidst SEC pressure. The SEC has legal actions pending against Binance.US and CEO Changpeng Zhao related to allegations of operating unregistered securities exchanges.

For further details, visit Binance.US and for SEC actions, check SEC.gov.

Best Lenders for Personal Loans

Avant (Best for Quick Approval)

550

9.95-35.99%

N/A

AmOne (Best of Low Credit Score)

Upstart (Best for Fair Credit Score)

OneMain Financial (Best for Good Rates)

None

18.00-35.99%

N/A

SoFi (Best for Good Credit Score)

Read More

- How to Make Money with Cryptocurrency

- How to Transfer From Coinbase to Coinbase Pro

- How to Transfer from Coinbase to Binance

- How Does Cryptocurrency Gain Value?

- How to Read Crypto Charts

Sources ▼

- https://www.binance.com/en/support

- https://support.binance.us/hc/en-us/

- https://twitter.com/BinanceUS/status/1666996908651323393

- https://www.binance.us/terms-of-use/