I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See all posts Frank GogolHow to Withdraw Money from Cash App

Cash App is one of the most popular apps nowadays, as it is a platform that makes money transfers easy and secure. It allows you to transfer money to your card, bank account, or even to your contacts. But even though it’s popular and quite complex, what many people don’t know is how to withdraw money from Cash App. Is it possible to make withdrawals and if so, how can you do this? Let’s find out!

Can Money Be Withdrawn from Cash App?

You can withdraw money from Cash App by linking a card to your account, transferring it to your bank, or sending it to a contact. Cash App operates similarly to Venmo, allowing easy money transfers and spending through a Square Cash Card. If you prefer returning funds to your bank account, it’s a straightforward process.

Even without a linked bank account, you can withdraw money, but account verification is essential to avoid limitations. Unverified accounts have weekly sending limits of $250 and monthly receiving limits of $1000. To increase these limits, you must link a bank account.

Additionally, you can withdraw funds by sending them to a trusted contact who can then transfer the money to your bank account.

How to Withdraw Money from Cash App on Your Phone

You can easily cash out your Cash App balance by following these steps:

In the Cash App mobile app:

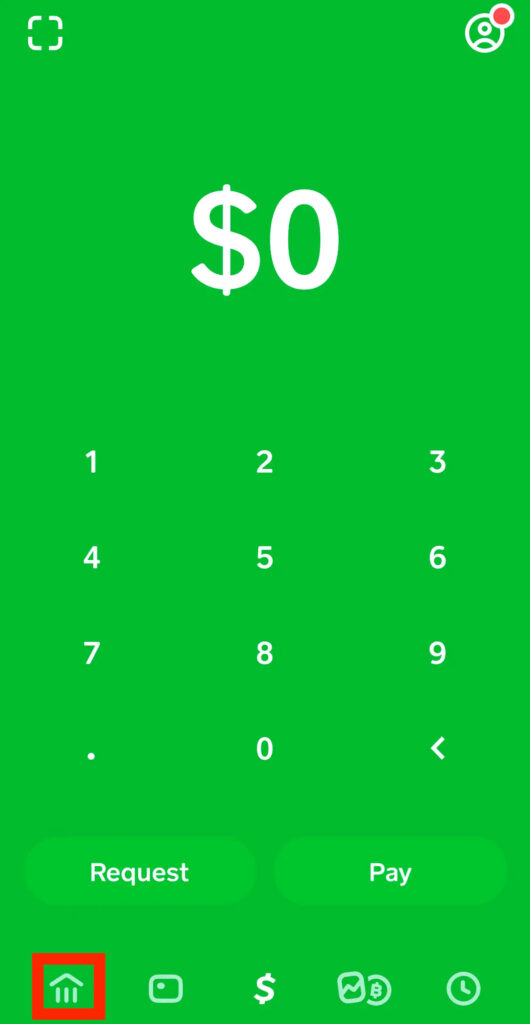

1. Tap the Banking tab on your Cash App home screen.

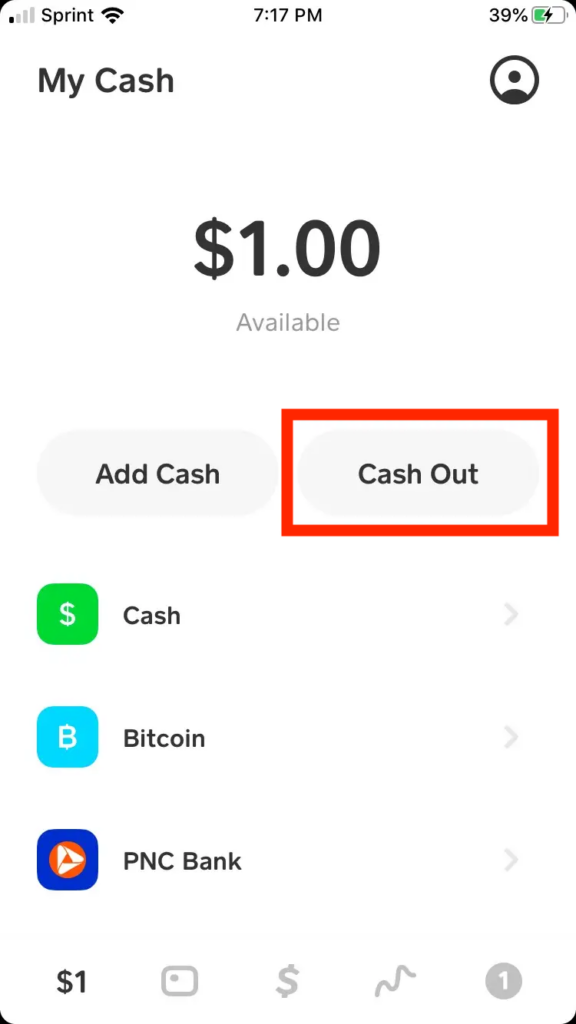

2. Select “Cash Out.”

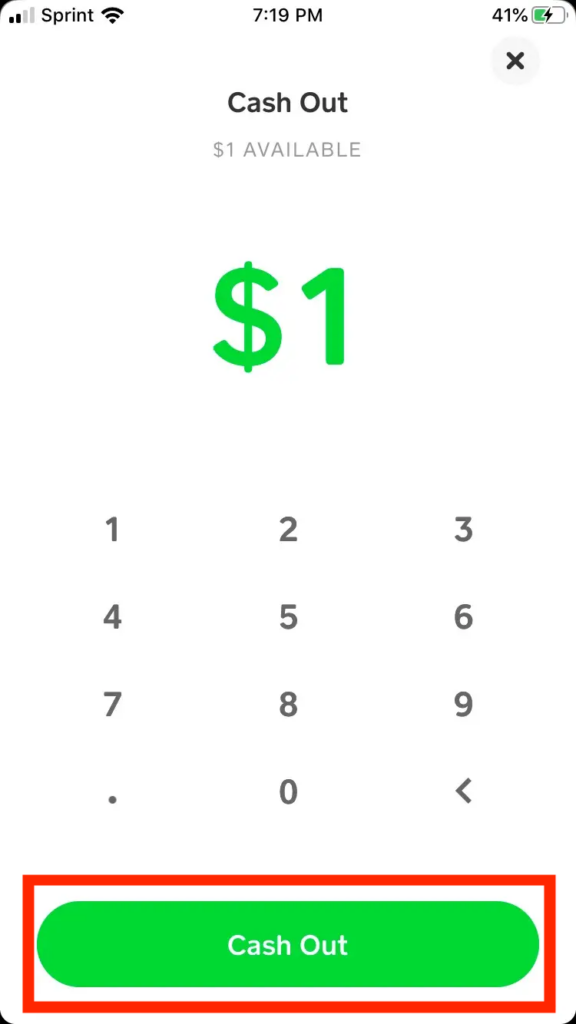

3. Choose the desired amount and tap “Cash Out.”

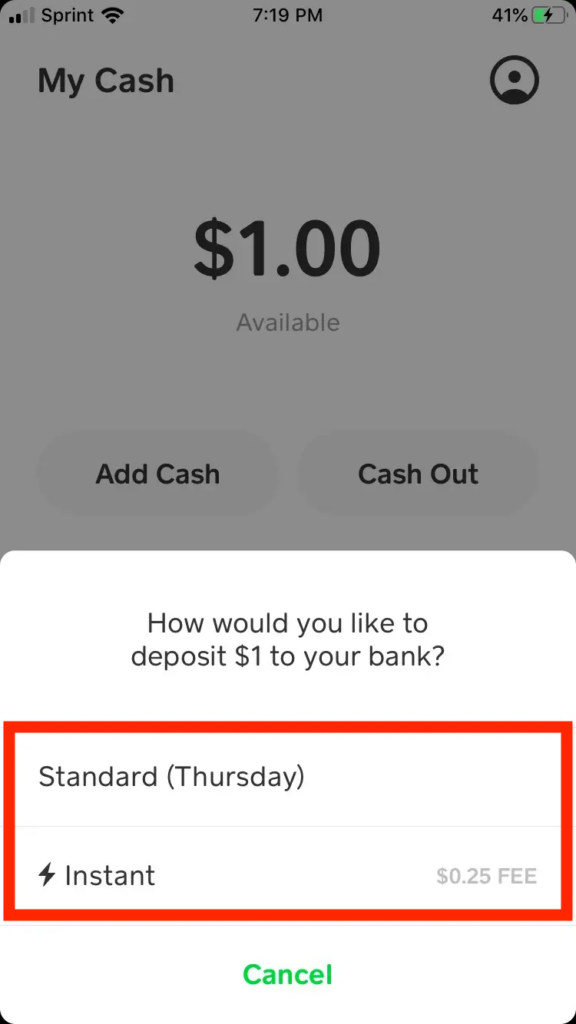

4. Pick a deposit speed.

5. Confirm the transaction with your PIN or Touch ID.

Alternatively, you can cash out online through the Cash App website:

- Log in to your Cash App account at cash.app/account.

- Click on “Money” on the left-hand side.

- Under your Cash Balance, click “Cash Out.”

- Enter or select the amount and click “Continue.”

- Choose your bank account and deposit speed, then click “Cash Out.”

Please note that depending on your chosen deposit speed, a fee may apply.

How Long Does It Take to Transfer Money from Cash App?

The time for money to transfer from your Cash App account depends on your chosen withdrawal option: Standard (1-3 business days) or Instant (instantaneous transfer to your bank account).

Rarely, funds may not settle in your bank account immediately, taking up to three days. To ensure it goes smoothly, monitor the payment status:

- Open Cash App on your Android or iPhone.

- Go to the Activity tab (easily accessible on the app’s home screen).

- Select the relevant bank transaction, then tap the button below to view transaction details. Checking the status applies to all payment activities.

Are There Fees to Withdraw Money from Cash App?

Cash App fees vary depending on the withdrawal method. Instant withdrawals typically incur a $0.25 fee for immediate access to your funds. To avoid fees, link a bank account or card to your Cash App, though it may result in slower processing times.

You can opt for a free Standard withdrawal, taking up to 3 days, as an alternative to avoid withdrawal fees.

How to Withdraw from Cash App Without a Bank Account

You can receive money on Cash App without linking a bank account, but there are important considerations:

- If you don’t link a bank account, the received amount will remain in your Cash App wallet and cannot be withdrawn as cash, as a Cash Card is required.

- To receive without a bank account, open Cash App, go to the “Activity” tab, find the pending payment, and click “Accept” next to the sender’s name. The funds will be added to your Cash App wallet.

- Having a linked bank account is advisable as it ensures faster transfers and a smoother transaction experience.

Withdrawing Cash from Cash App without a Card

If you haven’t ordered a Cash App card, don’t worry! You can still access your money without a physical card. Simply link your bank account to your Cash App by calling +(415)877–8473, and you can withdraw funds directly to your bank account.

ATM Withdrawals with Your Cash App Card

Yes, you can! The Cash App card functions like a traditional debit card, allowing you to withdraw cash from ATMs. Be sure to use ATMs within the network to avoid additional fees.

Where to Make Cash Withdrawals with Your Cash App Card

To withdraw money using your Cash App card, search for ATMs displaying the Visa Plus Alliance or MoneyPass logo. These in-network ATMs won’t charge additional fees for Cash App card withdrawals.

Read More

- How to Get a Cash App Refund

- How to Close a Cash App Account

- How to Add a Credit Card to Cash App

- Activate Cash App Card – A Step-by-Step Guide

- Where Can I Load My Cash App Card?

Conclusion

Withdrawing money from Cash App is very easy if you know the steps you need to go through. Just make sure to follow the process and everything will go smoothly. Withdrawing money can be done if you have a bank account or a card, but even if you don’t have one linked, you can still withdraw your funds.

Standard withdrawals will not charge you anything, but instant withdrawals will charge you $0.25. However, standard ones will take between one and three days, so make your choice depending on how fast you need the money.

Withdrawing Money from Cash App: Common FAQs

Below, you will find some commonly asked questions about Cash App withdrawals.

How do I withdraw money from the Cash App to my bank account?

You can withdraw money from the Cash App to your linked bank account by following these steps:

- Open the Cash App.

- Tap on the “Balance” tab.

- Select “Cash Out.”

- Enter the withdrawal amount.

- Choose your bank account.

- Confirm the transaction.

How long does transferring money from a Cash App to my bank account take?

Standard withdrawals to your bank account may take 1-3 business days to process. However, you can opt for an instant withdrawal for a small fee to access your funds immediately.

Can I withdraw money from a Cash App without a Cash App card?

Absolutely! You don’t need a Cash App card to withdraw money from Cash App. Simply link your bank account to Cash App and transfer funds directly to your bank.

What is the Cash App card, and how can I withdraw money using it?

The Cash App card is a physical debit card linked to your Cash App account. You can withdraw money using the Cash App card at ATMs that display the Visa Plus Alliance or MoneyPass logo. Remember to use in-network ATMs to avoid additional fees.

Can I withdraw money from my Cash App card at any ATM?

It’s best to use ATMs that are part of the Visa Plus Alliance or MoneyPass network to avoid potential fees. These in-network ATMs offer fee-free Cash App card withdrawals.

How do I withdraw money from a Cash App without a bank account?

While you can use your Cash App balance for purchases and payments, physical cash withdrawals require a linked bank account. To withdraw money without a bank account, you can consider transferring funds to a friend or family member with a bank account.

Are there fees for withdrawing money from Cash App?

Cash App typically doesn’t charge fees for standard withdrawals to your bank account. However, instant withdrawals may incur a small fee. Always review Cash App’s fee policy for the most up-to-date information.

Is it safe to withdraw money from a Cash App?

Cash App takes security seriously and employs various measures to protect your transactions and personal information. However, it’s essential to follow best practices, such as using a secure network and verifying transaction details before confirming withdrawals.

Can I cancel a withdrawal from the Cash App?

Once you confirm a withdrawal, it’s challenging to cancel the transaction. It’s crucial to review the details carefully before proceeding with the withdrawal.

Are there any limits on Cash App withdrawals?

Yes, Cash App imposes daily and weekly withdrawal limits for security purposes. The limits may vary depending on factors like account verification and transaction history.

Can I withdraw money from Cash App internationally?

Cash App primarily operates within the United States and does not currently support international transactions or withdrawals.

Why is my Cash App withdrawal pending?

Cash App withdrawals may sometimes show as “pending” due to processing delays. Standard withdrawals can take 1-3 business days to complete. Contact Cash App customer support for assistance if you experience extended delays or issues.